Prescription software firm Pear Therapeutics to go public via $1.6 billion SPAC deal, harnessing 3 FDA-authorized products and 14 candidates

Pear Therapeutics to Go Public in Roughly $1.6 Billion SPAC Deal (The Wall Street Journal):

Pear Therapeutics to Go Public in Roughly $1.6 Billion SPAC Deal (The Wall Street Journal):

Medical technology company Pear Therapeutics Inc. has agreed to go public by merging with a blank-check company with ties to the Pritzker Vlock Family Office, betting on the growing role of prescription digital therapeutics.

The proposed merger would give the combined company a pro forma equity value of about $1.6 billion.

Boston-based Pear Therapeutics is merging with Thimble Point Acquisition Corp. in a deal that’s expected to close in the second half of the year, subject to Thimble Point shareholder approval. Investors that include the Pritzker Vlock Family Office and Neuberger Berman Group funds are backing a roughly $125 million private investment in public equity, or PIPE, as part of the proposed deal. Pear Therapeutics’ current management team will lead the combined company, which will be called Pear Holdings Corp. The company would seek to trade under the ticker PEAR.

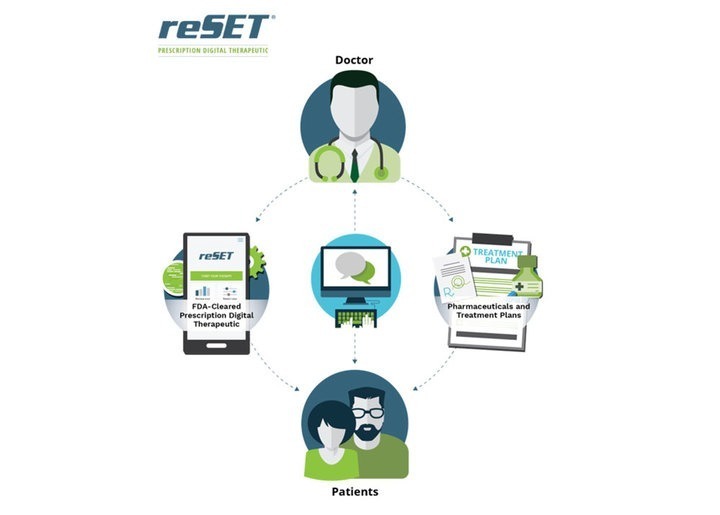

Pear Therapeutics … is one of the leaders in prescription digital therapeutics, or PDTs. A prescription digital therapeutic is a prescription software that delivers therapeutic intervention to prevent, manage or treat a medical disorder or disease.

PDTs are designed and tested much like traditional prescription drugs but rely on software approved by health regulators to treat patients. PDTs are seen as improving patient retention and, therefore, saving future healthcare costs.

The company, which isn’t yet profitable, has three products approved by the Food and Drug Administration, two of which have received approval to include claims on their labels for treatment retention, Chief Executive Corey McCann said.

The Announcement:

Pear Therapeutics to Become a Public Company and Expand its Leadership Position in Prescription Digital Therapeutics (press release):

“At Pear, we set out to transform healthcare through the use of PDTs, a new class of clinically validated, software-based therapeutics that we pioneered to improve patients’ outcomes across many therapeutic areas, alone and in combination with pharmaceuticals. With our end-to-end PDT platform, we are executing on our vision to redefine how patients, clinicians and payors can better navigate and benefit from a healthcare system so in need of disruption,” said Corey McCann, M.D., Ph.D., President and Chief Executive Officer … “We chose to invest in Pear because we believe it has the opportunity to become the primary commercial platform through which patients and prescribers access PDTs.” (said Elon Boms, Chief Executive Officer and Chairman of Thimble Point Acquisition Corp)

Pear is one of nine companies invited to participate in the U.S. Food and Drug Administration’s (FDA) Precertification Pilot Program. Pear has developed and commercialized the first three FDA-authorized PDTs, has 14 product candidates, and is scaling its platform for third-party product distribution opportunities. The Company’s three FDA-authorized products, reSET®, reSET‑O® and Somryst®, address large market opportunities with more than 20 million patients suffering from substance and opioid use disorders and more than 30 million from chronic insomnia, in the U.S. alone, respectively.